Whether Marina's view site has created buzz in the future?

Whether Marina's view site has created buzz for Singapore?

More than ever, under the Government Land Sales ( GLS ) reserve list will be break out by the developers, The Marina View White situation really ready for application and its potential can up to several hundred hotel rooms responding considerable hotel room in the future.

This location could catch up with the top of between S$1,380 and S$ 1,650 psf which equal with S$1,5 billion to 1,8S$ billion on the market now ( The Business Times ). If it is proposed for sale, could attract everywhere from 4 to 8 bids, some reckon.

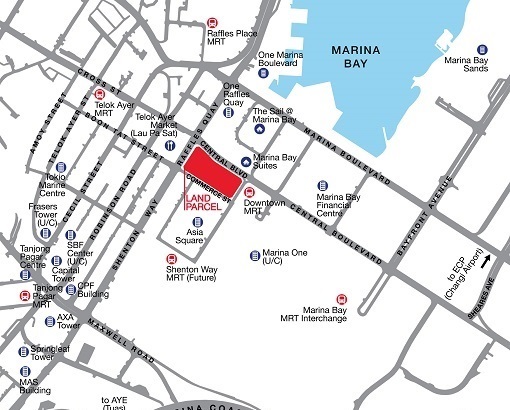

The White site has variety of works such as retail, food-and-beverage use, mix-use development with 905 residential and 540 hotel rooms and the 99-year parcel include two plots - a 7,817.6 sqm ( land parcel ) with 18 sqm in size ( underground space ). All sites had astonishing gross floor area ( GFA ) 101,629 sqm.

Further more to Marina View, under the GLS Programme for the second half of the year, two other sites were released for sale. The Urban Redevelopment Authority ( URA ) launched a 99-year site in Kampong Java Road, while the Housing & Development Board launched a 99-year, executive condominium ( EC ) site in Tampines Avenue 10. The former can yield 435 units and the latter, 695 EC units.

Given the Marina View's location in the Downtown Core and the future Shenton Way MRT station at its doorstep, the site would be attractive to major developers, developers with hotel interests, consortiums or real estate trusts, analysts said.

And with the supply of residential units in the area expected to be limited in the future, most units from new projects are likely to be snapped up, said Lee Nai Jia, senior director and head of research at Knight Frank Singapore.

The Mariana View Site was previously made available for sale through the reserve list since October 2011, but was removed in 2015 for a "review of its development plans", URA said on June 11, 2015.

Previously,there are over 70% maximum permissible GFA of 1,09 million sqf had be stored to office space. But now, surprised the figure nearly 21,530sqf (2000 sqm) can be alloted to optional office space. If gross floor area more than 2000 sqm, it's use for commercial like as shops or restaurants.

Christine Li, head of research at Cushman & Wakefield Singapore, expects that the hotel component aspect of the site would make it more attractive to developers compared to pure residential sites.

She said: "The outlook for the hospitality sector is improving due to the increasing number of tourist arrivals and limited pipeline of new hotel rooms.If triggered for sale, the site will be hotly contested by developers who wish to increase their exposure to the hotel market."

Hotels in the vicinity include the So Sofitel and The Westin. Noting that the hotel supply has tapered in general, Tricia Song, head of research (Singapore) at Colliers International said: "URA may have assessed that it is timely to have such a site on the reserve list to test the market."

Base on the industry data, the estimated hotel room is look forward to grow by 2,9%/year, by 0,9% in 2020.

According to Singapore Tourism Board, the number of visitors rose 7,5%/year - on - year in January to August as 12,61 million traveler came to Singapore's shores. Meanwhile, raise up purchasing real estate in this area from the people work surrounding.

"Despite the property cooling measures which kicked in on July 6, there will still be some degree of interest in the three sites under the GLS, with the Marina View land parcel being particularly attractive" Knight Frank's Mr Lee said that. Still, "(land bids) will probably be more reflective of the current conditions, compared to the beginning of the year, when the bids reflected future pricing", he added.

Ms Song said: "Developers have generally been more circumspect about land acquisition following the roll out of new cooling measures in July. We expect developers to continue to adopt a cautious stance in evaluating this latest slate of sites that have been launched."

Nicholas Mak, Executive director of ZACD Group said Marina View land parcel could attract a "moderate level of participation" if launched for sale within the next few months.

He had a compararison land sale. Then, defined the best is the White site at Central Boulevard, was sold on November 2016 for about S$2,57 billion, which worked to a land rate S$1,689 psf.

Read more relative project, please take a look at Singaporecondo

ENG

ENG